This is Crew pitch deck to raise their Series-A stage investment round. It is very simple but well put together. A slightly more colorful deck than one might expect from Apple.

It is longer in the number of slides that one might expect, but there is little concentration of information. The recommendation to have less than 20 slides is more related to the amount of time it takes to consume information. Since Crew only make one point a slide (or every few) the length isn’t really an issue.

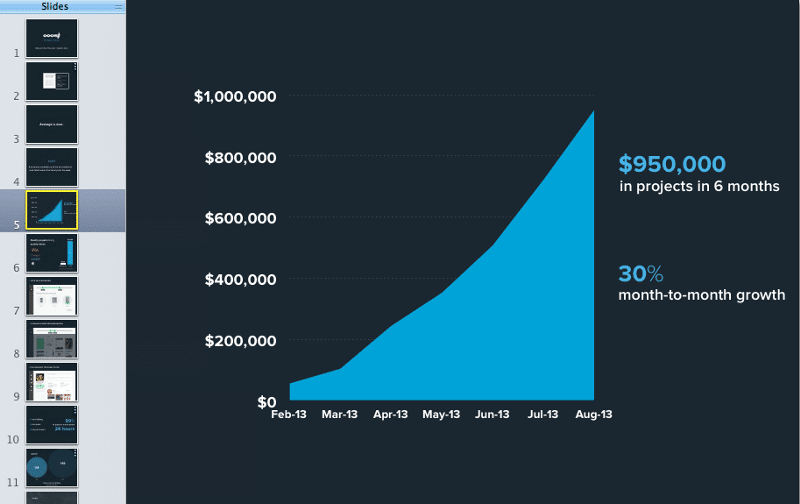

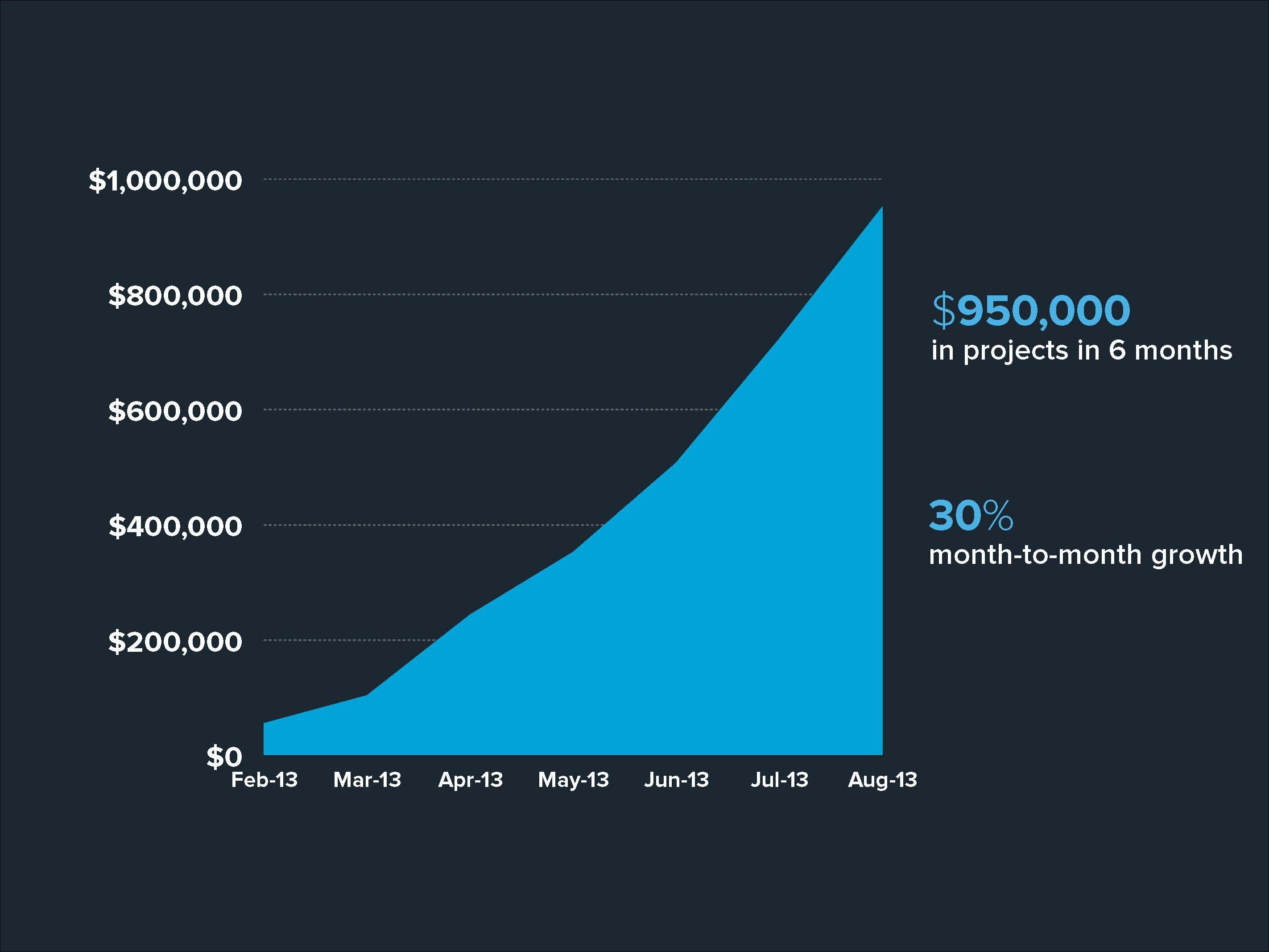

As one might reasonably expect, being a series-a deck, there are actual numbers and historicals in here. Rather than pasting an ugly excel output, what the management as being important are graphically portrayed across various slides.

About Crew

Crew (formerly Ooomf) is the world’s first marketplace where handpicked, talented mobile & web creators connect with and work on projects they love. On Crew, you’ll find the best freelance design and development talent out there, ready to start working today. Our highly trusted network of independent creatives has worked on products used by tens of millions of people for some of the industry’s biggest companies, including Apple, Google, Uber, IDEO, and Dropbox.

They have raised $12.03M in 3 Rounds from 15 Investors.

Approach to the pitch deck

This is all according to Mikael Cho, founder of Crew.

Here are the main elements that Crew considered including in their investor presentation:

- Introduction — Who are you? What is your company name?

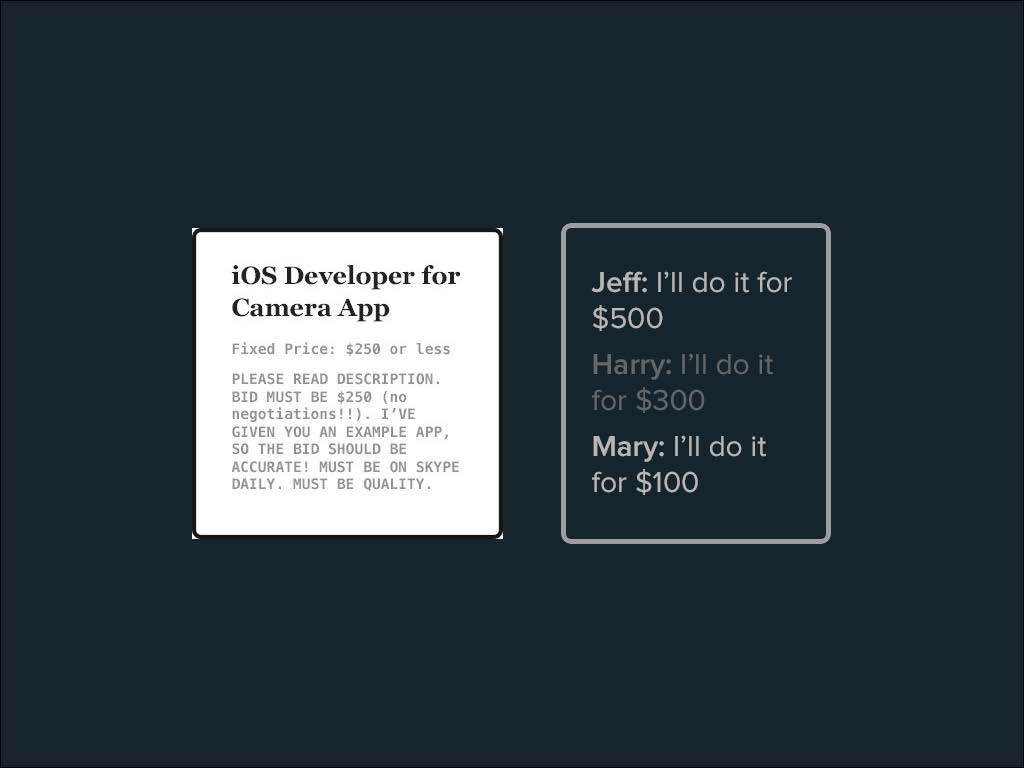

- Opportunity/Problem — What problem are you solving and/or what’s the opportunity you’re after?

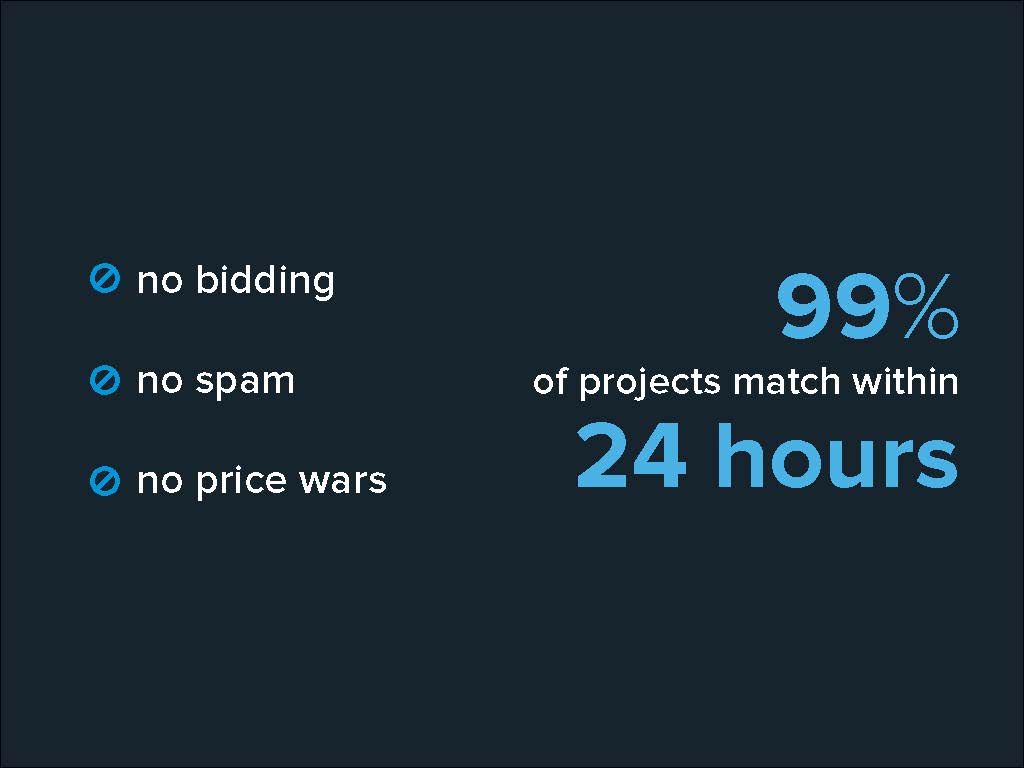

- Solution — How are you solving the problem?

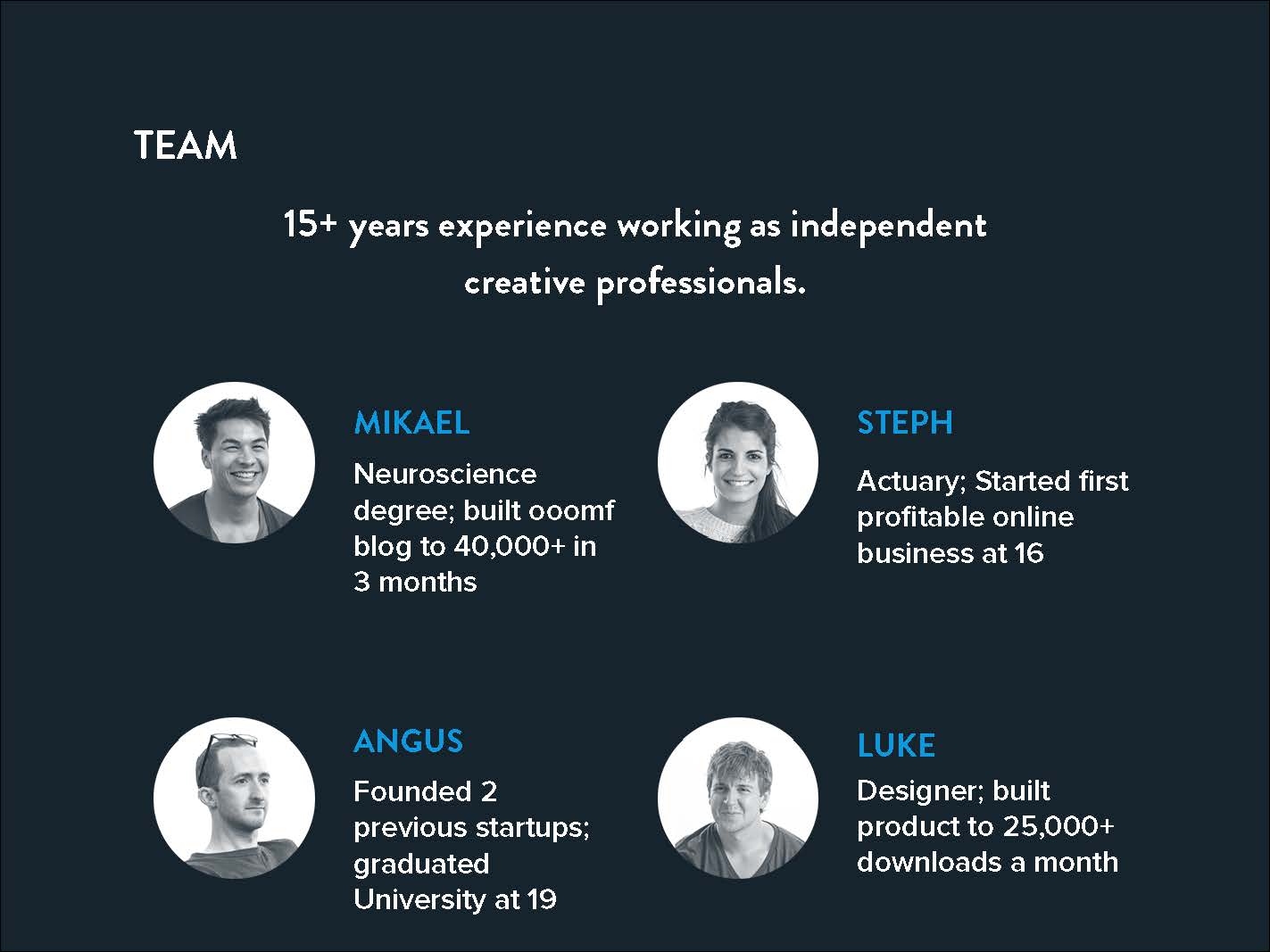

- Team — Who are the key members on your team?

- Traction — How fast are you growing over what period of time?

- Vision — Where are you going to be five years from now?

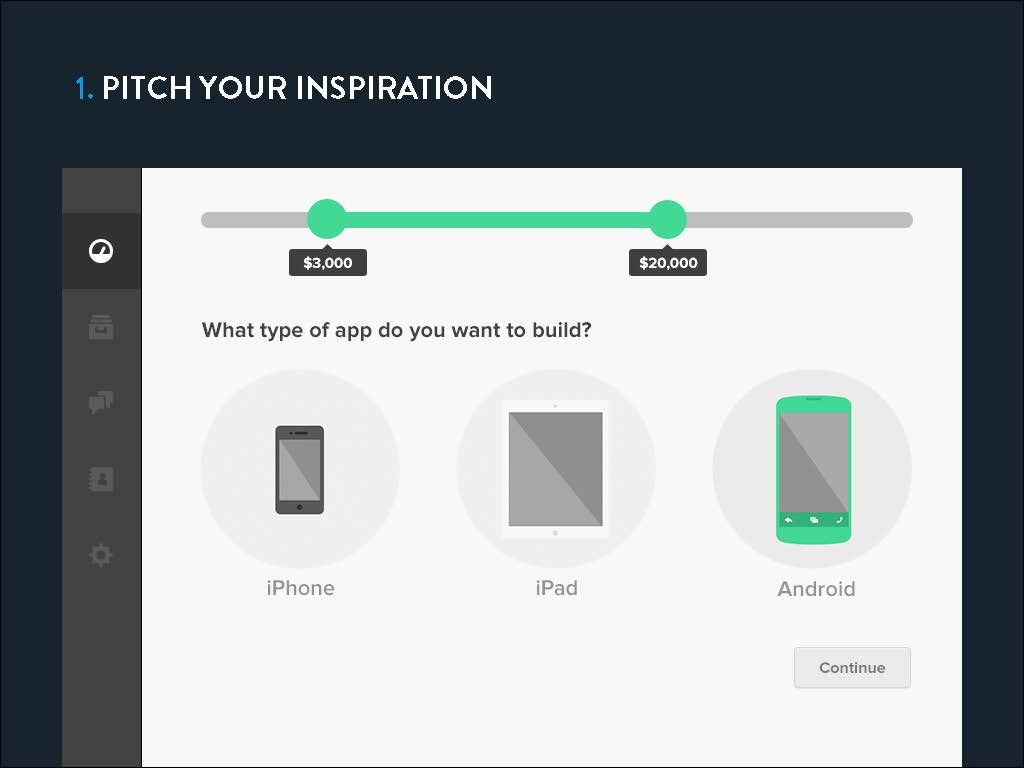

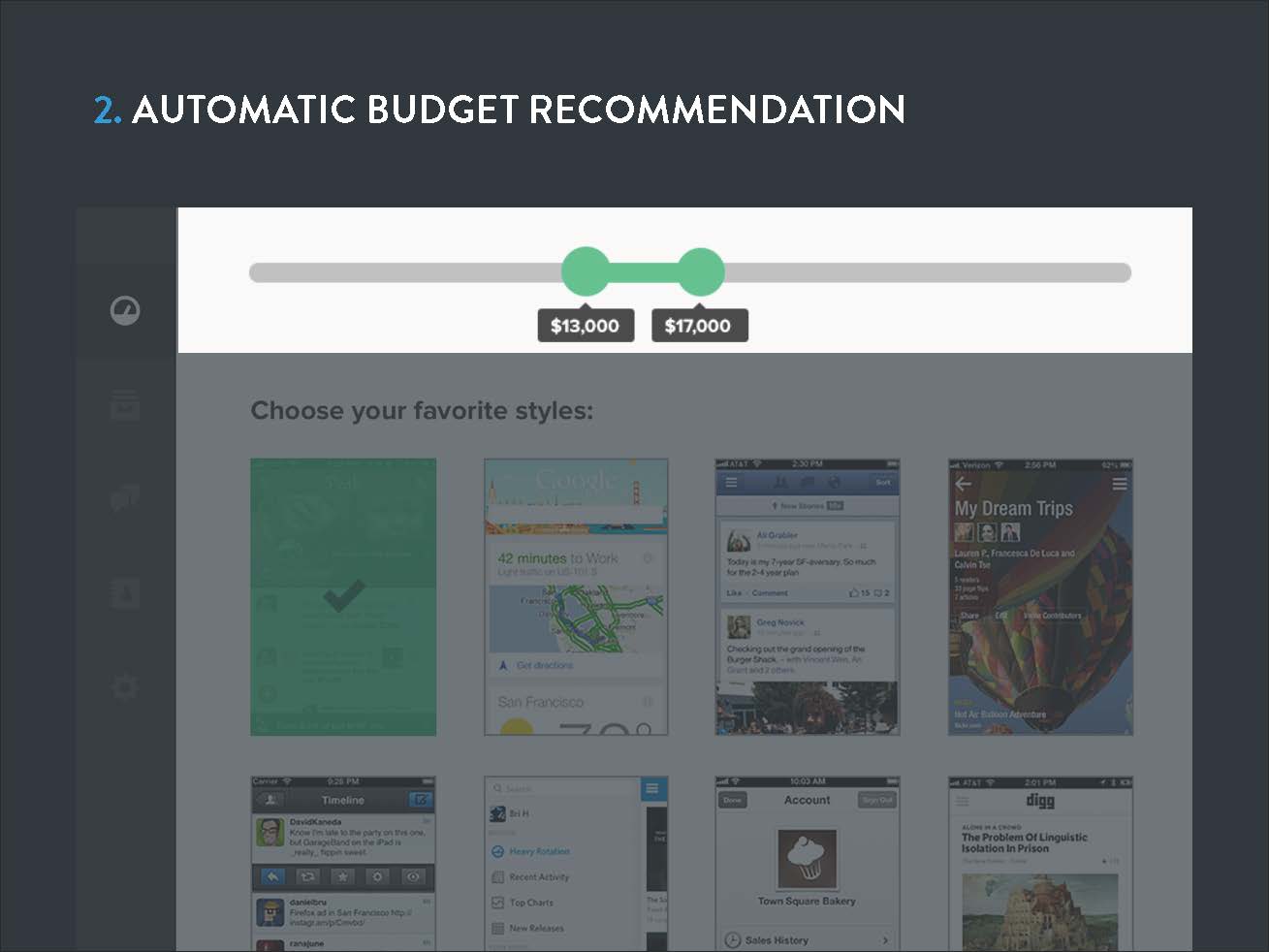

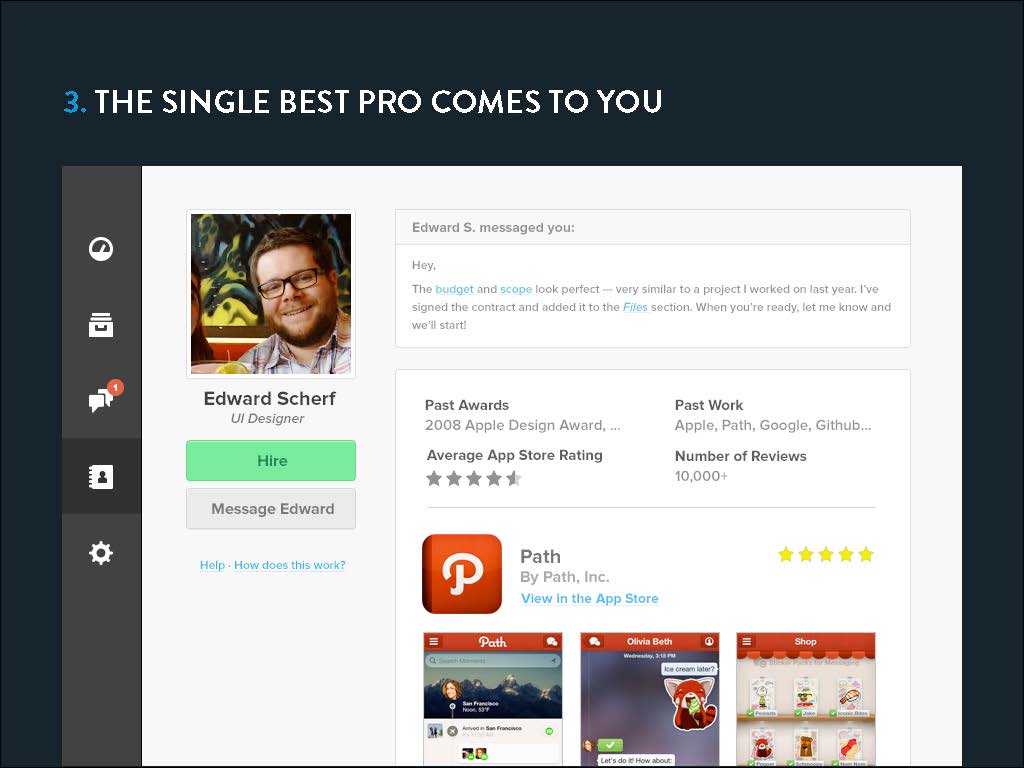

- Product — How does your product work?

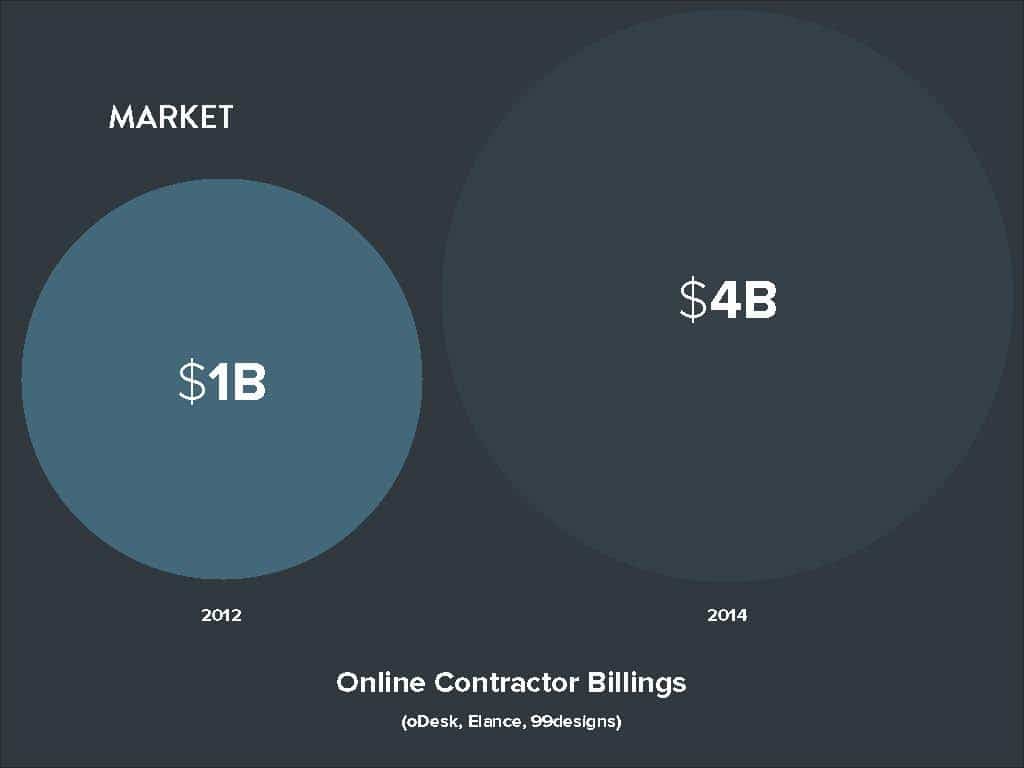

- Market — What does this market look like? Is it growing?

- Business Model — How do you make money?

- Customer Acquisition — How do you plan to grow?

Here’s the first sketch of Crew’s investor presentation focused around getting to the opportunity slide within the first few minutes. The structure would evolve, but they laid down an overview of their presentation to make it easier to understand the pieces they had to play with before getting into the details of each slide. This is great advice!

Work from big to small

Once they thought they nailed the general structure for our story, they moved the content into Keynote but still kept the presentation to just text on slides — no images or pretty typefaces yet.

They held on to the presentation for a week, reviewing the slides a few times each day to get a different perspective on how the story could flow. There are many different paths your story can go and giving yourself time to reflect on it will help you consider different alternatives that could make your story better.

Here’s their Opportunity slide in the first rough version of our Keynote presentation:

They believed the story was now at a point where it would be ready to share with potential investors so they polished the slides for presentation. Here’s the polished version of our deck focused on the opportunity slide which they called “The Shift”:

Note that they moved the point about their opportunity from the fifth to the third slide in their presentation. Their intent was to hopefully draw the attention of potential investors to this trend in the economy early on in their presentation.

At this point, they had yet to show their investor deck to any investors so they didn’t know how it would be received.

Before talking to new investors, they wrote to some of their current investors letting them know they were going to be sharing their story and would love for them to hear it first. Just like testing a product, they wanted to test their presentation by getting feedback from their target audience.

They went into these initial meetings thinking they had all the elements they were expected to have in a strong investor presentation, but when they finished sharing their story, there seemed to be a lack of enthusiasm.

They could feel there was no emotion in the room and their presentation felt flat. They reflected over the next few days, feeling deflated and wondering what went wrong.

What’s your difference?

They were lucky to grab coffee with my friend Julien Smith (who just raised an investment from notable investors including Gary Vaynerchuk). During their conversation, we ended up talking about how their team was working on their investor presentation.

They spoke about the opportunity in their market and how we were going about solving the problem. They started to sense the same emotional disconnect in this conversation with Julien that we experienced sharing their investor deck with their current investors.

They went on to note that we were growing at a rate of thirty percent month over month. Interestingly, once They told Julien this point about their growth, he stopped me and said,

“Hang on. What?”

“You’re growing how much? How fast?”

This sparked a thought that perhaps the focal point of their story should not be on the opportunity in their market, but rather their rate of growth was more of a sign that we were onto something.

Julien shared some thoughts about how we could structure their presentation to get to the traction elements of their story much sooner. After a restructuring of their investor presentation to focus on their traction, here’s the new version of their slides:

Our story was too predictable.

And because everything in their presentation was expected, it was like hearing a song get overplayed on the radio. No matter how good that song might be, you eventually become numb to it. You may even start to dislike it.

Investors see hundreds of pitches a year and can almost predict what’s coming next if the structure of your story seems to fit with something they’ve seen or heard before.

It seemed their presentation was being processed by investors as, “Yep, I’ve heard this one before” rather than, “Holy cow, you have my attention.”

Granted it’s hard to control all variables when trying to gauge how investors will feel about your pitch. Like most people, investor opinions are influenced by many factors outside of your control but getting early versions of your presentation in front of at least a few investors can help sniff out a story that might lack impact.

This “something that stands out” doesn’t necessarily have to be a novel idea, it could also mean a high rate of growth or a unique way of getting customers.

As AngelList founder Naval Ravikant explains,

Investors are trying to find the exceptional outcomes, so they are looking for something exceptional about the company. Instead of trying to do everything well (traction, team, product, social proof, pitch, etc.), do one thing exceptional. As a startup you have to be exceptional in at least one regard.

They saw the importance of getting their investor deck out early to get “real world” input. If they hadn’t shown their first presentation to anyone, they may have shared a weaker story with potential investors and conversations could have stalled.

There’s a lot that you could think of including in your investor presentation, but every company is unique so it’s up to you to determine how to tell your story the right way.

The main goal of your presentation is to get investors to understand that you could be onto something with your business. Focus on highlighting the sign(s) that point to this. In their case it was their traction but for your company, this sign could be an exceptional team, technology, or set of partnerships you have lined up.

Keep in mind that a strong investor presentation alone likely won’t raise you money, but it can only help your cause if you do it right.

Crew pitch deck

Need help with your deck?

Head over to Perfect Pitch Deck. Competitive pricing and expert assistance to get you fundraise ready and confident.

Want to see the 100 other pitch decks?

If you love pitch decks, check out the ultimate pitch deck collection here!

Something interesting to read…

- Super hack for annoying LinkedIn connection requests

- The Double Opt-In Email Introduction

- Email can suck less. Use this banker system to make startup emails work for your team

- Ask dumb questions. It’s the smartest thing you can do

Read all the decks

- 300 Milligrams Seed Stage Startup Pitch Deck –

- 6Wunderkinder pitch deck to raise series-B capital investment –

- AdPush Seed Startup Pitch Deck to Raise Venture Capital

- AIAR pitch deck to raise series-A capital investment –

- Airbnb pitch deck at seed stage investment –

- Appnexus Seed Stage Startup Pitch Deck

- AppVirality pitch deck to raise seed investment –

- Babylist pitch deck to raise seed capital investment –

- barcoo pitch deck to raise seed capital investment –

- Bidzuku Pitch Deck to raise seed investment –

- Binpress Pitch Deck to raise seed capital –

- Biogrify Seed Startup Pitch Deck –

- Bliss.ai Seed Stage Startup Pitch Deck to raise investment

- Boxcryptor pitch deck to raise seed capital investment –

- Brandboards Pitch Deck to raise seed capital –

- BrightNest pitch deck to raise seed capital investment –

- Buffer Pitch Deck to raise seed investment –

- Buzzfeed Startup Pitch Deck –

- Cadee Pitch Deck to raise seed investment –

- Canva pitch deck to raise seed round capital investment –

- Canvas Pitch Deck Seed Stage Startup to Raise Venture Capital

- Chewse Pitch Deck to raise seed investment –

- Cloudera Pitch Deck Seed Stage Startup to Raise Venture Capital

- Coinbase pitch deck to raise seed capital investment –

- Color.xxx Parody Startup Pitch Deck –

- Contently Pitch Deck Seed Stage Startup to Raise Venture Capital

- Crew Pitch Deck Series-A Startup –

- Cubeit Pitch Deck Seed Stage Startup to Raise Venture Capital

- Daily Hundred Pitch Deck to raise seed investment –

- DocSend pitch deck to raise angel round capital investment –

- Dropbox pitch deck to raise seed capital investment –

- Dwolla Startup Pitch Deck to raise seed investment –

- eShares Pitch Deck Seed Stage Startup to Raise Venture Capital

- Farmeron Pitch Deck to raise seed investment –

- Fittr Pitch Deck Seed Stage Startup –

- Flowtab Pitch Deck Seed Startup –

- Foursquare Pitch Deck to raise startup seed capital –

- Front pitch deck to raise series-b capital investment –

- Front Series A SaaS Startup Pitch Deck to Raise Venture Capital

- Fynd pitch deck to raise pre series a capital investment –

- Fynd pitch deck to raise series c capital investment –

- Fyre pitch deck and investment analysis –

- Gazemetrix Pitch Deck to raise seed capital –

- Hampton Creek pitch deck to raise series-b capital investment –

- Hubbub pitch deck to raise seed capital investment –

- Iconfinder Pitch Deck Startup –

- Indiez pitch deck to raise seed capital investment –

- Instamojo pitch deck to raise seed capital investment –

- Intercom pitch deck pre-seed convertible fundraise –

- Kejahunt pitch deck for startup fundraising –

- Kibin pitch deck to raise seed capital investment –

- Lastbite Pitch Deck for startup seed raise –

- Launchrock Pitch Deck Seed Stage Startup –

- Limetree pitch deck to raise seed capital investment –

- Linkedin Series-B Pitch Deck –

- Locus pitch deck to raise seed capital investment –

- Love with food pitch deck to raise seed capital investment –

- Mandae pitch deck to raise seed stage investment –

- Manpacks Pitch Deck Seed Stage Startup –

- Mapme growth Stage Startup Pitch Deck

- Mattermark pitch deck Series-A –

- Metacert Pitch Deck Seed Stage Startup to Raise Venture Capital

- Mixpanel Pitch Deck Series B Startup –

- Monzo pitch deck to raise series-B capital investment –

- Moz pitch deck Series B startup –

- MySql Pitch Deck Series-B Startup to Raise Venture Capital

- NextView pitch deck template for startups –

- Panjo pitch deck to raise series-A capital investment –

- Pendo Pitch Deck Series-B Stage Startup to Raise Venture Capital

- Perlara pitch deck to raise series-A capital investment –

- Pinmypet Seed Startup Pitch Deck –

- Polyflint Pitch Deck Seed Stage Startup –

- Popsurvey Pitch Deck for investment –

- Profitably pitch deck to raise seed capital investment –

- Puptimize Pitch Deck Seed Stage Startup to Raise Venture Capital

- Resgrid pitch deck to raise seed capital investment –

- Rocket Internet pitch deck to raise growth capital investment –

- Sequoia Capital Pitch Deck Template –

- Shift pitch deck to raise series-B capital investment –

- Smart Host pitch deck to raise angel round capital investment –

- Standard Treasury Pitch Deck Startup –

- Talkdesk pitch deck to raise seed capital investment –

- Task.ly Pitch Deck for startup fundraise –

- Tealet Seed Stage Startup Pitch Deck –

- The Knot growth Stage Startup Pitch Deck

- Theranos pitch deck to raise series-c capital investment –

- Thrive Global Series A Startup Pitch Deck to Raise Venture Capital

- Tinder Pitch Deck Seed Stage Startup to Raise Venture Capital

- Transferwise pitch deck to raise seed round capital investment –

- Twine Pitch Deck Seed Stage Startup to Raise Venture Capital

- Uber pitch deck to raise seed capital investment –

- Urjakart pitch deck to raise seed capital investment –

- Vettery Pitch Deck Seed Stage Startup to Raise Venture Capital

- Vidcaster pitch deck to raise seed capital investment –

- Wattage pitch deck to raise seed investment capital –

- Waygo Pitch Deck Seed Startup –

- WayPoint Seed Stage Startup Pitch Deck –

- Wealthsimple Seed Startup Pitch Deck to Raise Venture Capital

- Wealthsimple Seed Startup Pitch Deck to Raise Venture Capital

- WeddingLovely pitch deck to raise seed capital investment –

- Wegreek Seed Stage Startup Pitch Deck –

- WeWork Pitch Deck Series D –

- What would a pitch deck by Walt Disney look like? Find out –

- Wunsch Brautkleid Seed Stage Startup Pitch Deck

- Yomp pitch deck to raise seed investment –

- Youtube Seed Stage Startup Pitch Deck